Author – Joe Turkal, LtCol (Ret) USMC

In the U.S., Americans take as many individual paths in life as there are individuals. Is there a single, indisputable path for Americans to follow that will lead to financial success? This could be debated for centuries by professionals and novices alike with no definitive answer. As a professional fiduciary financial advisor, I can however share what I believe to be a general roadmap, that if followed, will lead to a comfortable, well-financed retirement / golden years. As I describe the roadmap to financial success, it will follow an ideal scenario that is a chronologically based roadmap beginning in one’s early twenties and culminating with a successful retirement / successful golden age. However, I will proceed under the caveat that this methodology can be adapted to any stage of life and provide positive results, so in effect, it is never too late to improve one’s financial situation. The roadmap can be categorized into three phases: build a foundation, build wealth, and preserve wealth. In this article, I intend to provide prudent steps and actions to take chronologically in life that will lead to financial success, or in other words, a roadmap for financial success.

Phase One – – Build a Foundation

Phase one, the foundation, will span two fundamental financial areas: budget and risk management. The foundation begins with understanding and implementing a fundamentally sound methodology for one’s personal budget. The methodology that I will espouse in this article is the 60/20/20 methodology. This requires a budget that dedicates no more than 60 percent of one’s income to non-discretionary spending. Think of this as the bedrock of the foundation, meaning that without solid bedrock supporting one’s foundation, success will not be achievable. In other words, being in the position to spend no more than 60 percent of one’s income on non-discretionary costs is the initial “price of admission” to start one’s successful journey on the road to success. Until this is achieved, it should be one’s highest priority. Non-discretionary costs are mandatory spending on basics such as food, shelter, and security. Examples are housing, groceries, insurance, health, and transportation. Simply put any cost that supports those things in life that are essential for you and your family’s well-being, as well as supporting a sustained income. A common example of not adhering to this principle is when someone refers to their situation as being “house poor”. Meaning their mortgage or rent is consuming well beyond their resources and pushes them well above the 60 percent spending level.

Next, spend no more than 20 percent of income on discretionary items. So, think of items or services that increase pleasure, such as entertainment (yes, even a streaming service or smartphone service), vacations, and dining out (food is essential, but splurging is not). Discretionary spending should be considered the area with the most flexibility in your budget, meaning that if discretionary spending is too high, or there is a desire to save more, then discretionary spending is the area of the budget that should be cut back to prevent the need to borrow now or in the future.

Lastly, allot at least 20 percent of income to savings. Notice the shift in phrasing from the two former categories where the restraint is spending no more than 60 or 20 percent, in this case, one must allot at least 20 percent to savings. When I speak of saving, this includes all savings, including emergency savings as well as short, mid, and long-term savings. Think of short-term (1 year or less) as saving for a trip or a new appliance. Think of mid-term as saving (1 to 5 years) for a new vehicle or house. An example of a long-term savings goal is children’s higher education costs. Retirement savings are also long-term, but we want to separate this long-term savings category into its own bin, because of its importance as well as the specialized savings vehicles that have been created by Congress specifically to enhance and encourage this type of savings. If all Americans employed this budget in their early 20s and stayed consistent, barring a tragic life altering event, this alone would likely lead to financial success. This begs the question: once the bedrock is achieved, why don’t all Americans follow this path? This methodology requires effective budget tracking along with consistent financial discipline. Once sufficient income is achieved, I would argue that the main root cause of so many not employing this strategy early in life is a lack of financial education, combined with a national material focused culture.

Once proper budget management is employed, the next step in building a solid foundation is to mitigate risk by preventing a catastrophic financial loss, which involves ensuring that one has adequate insurance in place to cover potential catastrophic events. The four fundamental insurances are auto, home (or renters), health, and life insurance. A new category that has become, arguably just as important, is cyber or fraud insurance. Risk management is an absolutely essential piece to one’s foundational financial success. These insurances are there to mitigate a catastrophic event that could derail not only one’s financial success, but also overall success in life. In the case of auto, one could endure the loss of a vehicle, this is not catastrophic, but the liability or personal injury of an auto accident could certainly jeopardize one’s future success. In the case of home (or renter’s) insurance, fire or other event could wipe out one’s home and all his / her possessions. Health insurance mitigates an unexpected health event that could drain savings and drive a household into debt. Life insurance protects our loved ones and allows them to stay on track for their financial success. Finally, fraud insurance has become a key part of risk mitigation in the current environment due to the potential cyber or fraud tactics employed by criminals that have become a significant risk to one’s net worth.

Phase Two – – Build Wealth

With a solid financial foundation established, the goal of building wealth now becomes more than just facilitated, there is actually an element of inevitability. The last sentence should entice the reader into wanting to understand more, but first, before proceeding, I want to reiterate that what is being presented is the gold standard, ideal chronological roadmap. In reality, few things in life proceed down the ideal path, so keep in mind that there could be fits and starts, disruptions, and challenges along the way. So, while the ideal chronological path is not necessary for success, ultimately one must have unwavering commitment to the principles and the priorities. So, in reality, the order of actions may flow differently; one could find and dedicate to the path at a later time in life, and every individual’s journey is different, but by prioritizing the phases in order to build a solid foundation, then growing wealth and lastly, preserving wealth will lead to success.

The phase of building wealth starts in the previous phase of building a foundation. Consider the former statement of inevitability because of this foundation. One has now established a disciplined approach to budget management combined with the 60/20/20 strategy. Meaning for an extended period of one’s life, annually, 20 percent of income goes into savings. It then stands to reason that in order to make this phase the most impactful, a set of rules and prioritization should be established for those savings.

By far, the biggest opportunity for most Americans resides in a work-sponsored retirement benefit. Most are familiar with a 401k savings account sponsored by their employer. Other common forms are the Thrift Savings Plan (TSP), for federal workers and military, a 403b / 457 program for most state and local government employees, and non-profit organizations.

As the United States economy began to experience growing global competition during the 1950s through 1980s and moved toward a globalized free trade policy, manufacturing was increasingly being outsourced to developing nations, and the U. S. economy was transformed from an industrial-based dominated economy to a service industry-based economy. Globalization, de-industrialization, and global competition gave rise to multinational corporations. With companies looking for every competitive advantage, wages and compensation became an area to find efficiency. One could argue, this was the impetus to move away from defined benefits programs (i.e., pension) to defined contribution programs (i.e., 401k). This transferred much of the costs and risks away from the company to the employee. However, companies still need to recruit and retain the best employees, so along with most defined contribution programs (with the help of regulations from laws passed by laws passed by Congress), most employers offer some form of matching contributions. A typical matching benefit from employers looks like the employer will match 100 percent of an employee’s contributions to 401k/TSP/403b up to 5% of his/her income. So, if an employee makes $100,000 in wages annually, the employer matches contributions up to 5% or (100,000 x .05) $5000. Priority number one in savings (after the foundation is soundly established) is to contribute up to the employer’s match. In this case, the employee’s first savings priority would be to contribute $5000 per year to their 401k/TSP/403b. The common adage to describe this opportunity is, “do not leave money on the table”. This is a significant piece of the total compensation package. The choice is clear: either contribute the $5000 annually or one will forgo an extra $5000 in compensation per year. It is very rare to get a 100% return on an investment – – take it – – do not “leave money on the table”.

Now, where should one direct the next dollar saved? Paying down and eliminating high-interest debt is paramount (e.g., monthly rolling high-interest payments to credit cards or lines of credit). Again, instead of viewing the roadmap in a strict chronological order because many actions overlap. One should think more in terms of a chronological plan with prioritization. So, should one forgo paying down high-interest debt in order to get the employer’s match? Typically, they should be done simultaneously by looking for wiggle room in the budget, such as reducing a lower priority, such as discretionary spending. Here is a simple rule, if one has debt with an interest rate that is higher than what can be achieved through investing, those dollars are better deployed by accelerating debt payment above the minimum payment. Here is a more concrete example. Let’s assume one can achieve an average of 7 percent on investments. In this case, it is more efficient to pay the minimum payment on any debt below 7 percent and to accelerate payments on any debt above 7 percent. Each decision on where to employ the next dollar has an opportunity cost. In this case, every extra dollar deployed above the minimum payment on a low-interest loan is less efficient than investing it and getting a higher return and vice versa. This is a fundamental principle that can be very difficult for some to employ because they have a predisposition to want to extinguish debt. In this case, one must understand that it is in his / her financial interest to employ that dollar in the most efficient manner for the best results.

The next highest priority for savings is to build a sufficient emergency savings fund. This action has a positive effect both on building wealth and providing a buffer for building financial resilience. The emergency fund will serve the dual purpose of providing a savings buffer to bridge a temporary gap in income and/or to adapt to unexpected costs that might otherwise cause one to borrow at a high interest rate or be forced to disrupt one’s 60/20/20 budget strategy.

The main purpose for building an adequate emergency savings fund is to span a temporary loss of income. An adequate emergency fund should range from between three to twelve months of non-discretionary expenses. The range varies based on income stability and reliability. The more stable and reliable one’s income, the lower the emergency fund and vice versa. For example, a person with a steady wage with high job security and no plans for transition is adequate with three months of savings, as opposed to an individual who lacks job security, has varied income and/or is close to transition would be wise to have up to twelve months of savings. The main purpose being, if income is interrupted, the emergency fund is there to span the short-term essential costs.

A secondary benefit of building an emergency fund is to build resilience to one’s budget strategy by affording the opportunity to address an unexpected cost. (e.g., a large appliance needs to be replaced or unexpected vehicle maintenance), without using a high-interest credit card to finance. Instead, one can address the unexpected cost with the emergency fund. This is in essence a self-funded interest free loan. Keep in mind this is a loan from one’s emergency fund and it is critical and pay it back to make the emergency fund whole again. The emergency fund becomes a powerful tool for staying on track to build wealth and provide budget resilience, strengthening one’s financial foundation.

Once the employer match and emergency fund are achieved, the next dollar saved should be contributed to an Individual Retirement Account (IRA) (for the sake of accuracy the term used by the Internal Revenue Service (IRS) is Individual Retirement Arrangement). On the ideal path, the individual would still be relatively young, in a relatively low tax bracket, with a long-time horizon until retirement. In this case, the clear choice for the next saving dollar goes to a Roth IRA. To answer the question up front, why not just increase the savings in the work-sponsored 401k? Once the employer match is achieved (remember “don’t leave money on the table”), the Roth IRA has several advantages over employer-sponsored plans. The Roth IRA is instead a personal retirement savings account that typically affords better investment diversification options and is more flexible in several ways. For example, a huge advantage over 401k is typically one cannot distribute from a 401k account early and even if one could they would be subject to taxes and early withdrawal penalties. In a Roth IRA, the owner can always withdraw the invested principle, tax free, no penalty. It is only the gains that are subject to potential early withdrawal taxes and penalties. Additionally, by default the IRS assumes principle first on withdrawals, meaning upon withdrawal, even if before age 59 and a half, the IRS provides the individual with the benefit of the doubt and considers all withdrawals to be from principle first, avoiding fees and taxes unless the amount supersedes the principle. Though not ideal, a Roth IRA is a great backup emergency fund or vehicle to fund a child’s education.

The next savings priority is short-term (1 year), mid-term (2-5 years), or long-term (more than 5 years) goals. This could be a vacation (short-term) or a house (mid-term), or children’s higher education (long-term). Granted, life priorities are different for individuals, so this could replace the Roth IRA in one’s personal prioritization. These savings are not intended for retirement and depending on the time horizon of execution, different savings methods can be used. For short term, a regular savings account at a bank is fine, but for better returns a high yield savings account would be a better choice. These days, high yield savings accounts tend to be as user friendly as regular savings accounts, they just provide a higher return. For a mid-term goal, two options would be a bank Certificate Deposit (CD), which is less liquid (meaning there is a waiting period to withdraw) or an individual investment account. This is a brokerage account typically invested in stocks and / or bonds. This account can provide a higher return than CD’s but is subject to market volatility. An individual investment account does not have tax advantages like a retirement account but provides flexibility to contribute or withdraw at any time with no penalties (however, once gains are realized, one must pay taxes on the gains).

At this point on the roadmap, if income continues to increase and there is still extra capacity for savings, the next best avenue to focus on is increasing contributions to one’s work-sponsored retirement plan up to the legal limit and taking full advantage of the tax advantages that these programs provide.

Phase Three – – Preserve Wealth

The journey along the financial roadmap to success at this point has been long, likely arduous at times, and well-disciplined. At this point, a level of wealth has been obtained that, with solid management and wise methods, will preserve this wealth for the remainder of one’s life, while achieving all financial goals. Throughout the phases, there are overlapping steps to take in transition to the next phase to set ourselves up for success. The transition from stage two to three is no different. A crucial step to begin in stage two in order to set the proper environment for stage three is to employ an effective investment glide path. A glide path is the action of slowly and methodically reallocating investments from a more volatile, aggressive investment posture to a less volatile and conservative posture. As the time horizon from phase two to phase three begins to shorten, it is extremely important to reduce the volatility and move from an aggressive wealth building portfolio allocation to a more conservative wealth preservation allocation.

Volatility in a portfolio of investments reflects how much and how quickly the portfolio’s value can rise or fall in the short-term even if the long-term trend is positive. So, imagine keeping a very volatile portfolio just up to the edge of phase three (i.e. retirement) and then a significant market decline occurs. The objective is to reduce that volatility as one gets closer to phase three in order to prevent or more precisely mitigate a poorly timed market drop just before phase three, which would result in leaving no time horizon for the portfolio to recover. A portfolio that at this point is one of the most, if not the most important assets in retirement.

Moving to a less aggressive investment allocation goes hand-in-hand with reducing volatility and is a key component to achieving reduced volatility. Put in simple terms, a higher percentage of stocks to fixed income investments (bonds and cash) will be more aggressive, whereas increasing fixed income instruments in relation to stocks in an investment portfolio will produce a more conservative portfolio.

These two actions in portfolio management, reducing volatility and decreasing investment aggressiveness, should be done methodically and slowly over time, leading up to phase three. This is what is termed an investment glide path. Not only is this the most efficient path, but it accomplishes its main goal of reducing the risk of a market drop and a tragic loss in one’s net worth just prior to phase three.

As one advances through phase two and approaches phase three, financial actions do not necessarily become more important than any other period, but they do become more and more complex to understand and execute. This is the period where one must either dedicate an enormous amount of time to learning the intricacies of financial and tax planning or hire a professional to assist in the planning and implementation.

Once the investment glide path is in place, one is well positioned for success in phase three. The main goal of phase three is wealth preservation, so one decreases superannuation risk (risk of running out of money before the end of life) and continues to live a quality of life and achieve all financial goals. As one enters phase three, the glide path has established a proper investment allocation. Phase three is the most complex phase to plan and implement, which is why so many retirees rely on tax and financial professionals.

The complexities of wealth preservation strategies are beyond the scope of this article, so instead, I will lay out a few principles for success. Principle number one – – do not forget that budget discipline along with a well-managed budget approach is the foundation. However, the good news is the 60/20/20 rule can now be altered. There is no longer a need for savings. With proper management and execution, your savings are sufficient to support your financial goals. Imagine that, with all the hard work, 20 percent of one’s budget has now just been eliminated. Now, budget management is focused on discretionary and non-discretionary costs. The goal here is to reduce non-discretionary costs leaving enough budget to achieve all financial goals.

Next, wealth management is highly important. This means that between fixed income (e.g., social security, pension, etc.) and investments, there is sufficient ongoing income until the end of life. Remember this, principle two is sufficient savings well-invested and managed should preserve at a minimum the starting principle, while allowing for withdrawals to keep up with inflation. There are differing strategies to be aware of, the first being a “spend down” plan. This wealth preservation plan’s intention is to make income last until the end of life, increase cash flow to keep up with inflation, but spend down an entire portfolio to include principle by end of life.

The other wealth preservation plan uses earnings only for cash flow and preserves and slightly grows principal to keep up with inflation. This is referred to as a “capital preservation” or “income only” approach. Either approach is viable, however as a planner, I always recommend planning for the capital preservation approach to wealth preservation. This capital preservation method is much less risky because end of life cannot be reliably predicted and there may be exceptionally high unexpected long-term care expenses. In either situation the capital preservation method keeps cash flow in place until end of life and is there as a backstop to mitigate unexpected costs in the golden years.

To employ either strategy, an efficient withdrawal strategy must be implemented. One very effective and popular withdrawal strategy is known as the 4 percent rule. This rule rides on the assumption that investments are achieving at least 3-4 percent after inflation or in other words 2 to 3 percent above inflation. If inflation averages 2%, the required portfolio return is 4 to 5 percent. In doing so, this method should maintain enough principle to be able to safely withdraw 4 percent annually, while consecutively growing the principle enough to keep up with inflation without depleting for at least 30 years. For example, if a portfolio’s beginning value is $900,0000, then one could safely withdraw $36,000 (900,000 x .04) in the first year, increasing each year to adjust for inflation.

The third and last principle I will discuss is keeping non-discretionary costs as low as possible by being tax efficient and reducing one’s tax bill as well as one’s taxable income. Again, the strategies are too complex for the scope of this article, but since I was in the Marine Corps for 30 years, I like to think of it in military terms. A key principle in war fighting is to confront the enemy at the time and location of one’s own choosing to create the best chance of success. If one thinks of taxes as the enemy in this analogy, then one must strive to pay taxes at the most favorable time and place (i.e., lowest tax bracket). There are financial tools to avoid or severely reduce required minimum distributions (RMD), such as Roth conversions. RMD’s force disbursements from pre-tax retirement accounts that, depending on date of birth, commence from age 73 to 75, until all savings are disbursed. This results in forcing taxes to be paid, increasing taxable income, and potentially withdrawing dollars when not needed. RMDs are the enemy of choosing the time and place to pay taxes. There are many more tax efficient steps that can be employed, but again these get increasingly complex and assistance from a tax and financial professional becomes ever more important.

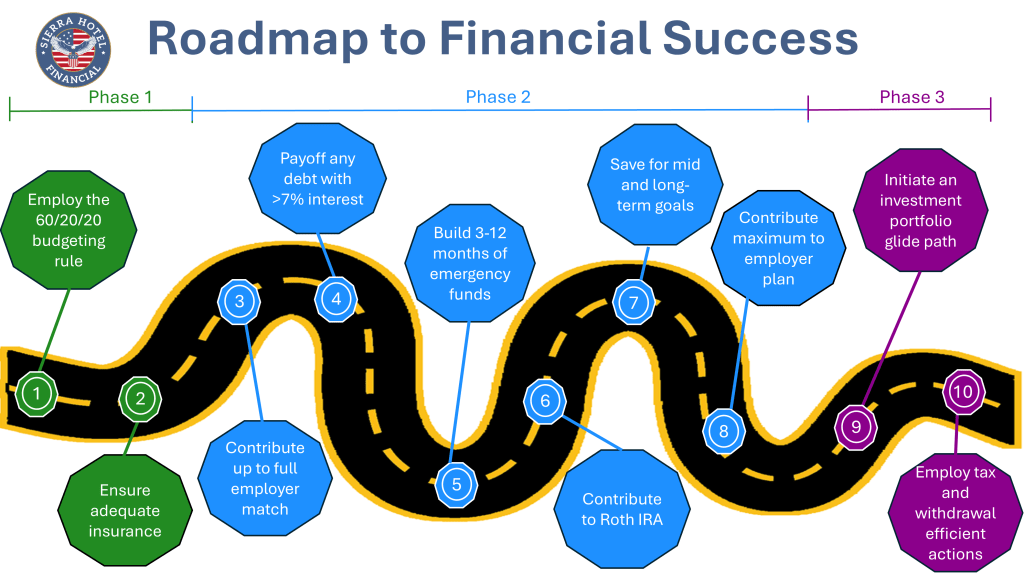

Figure 1 is a simple graphic that captures the phases and steps along the roadmap to financial success. The three phases are: build a solid foundation, build wealth, and preserve wealth. Phase one starts by accomplishing the quintessential step of achieving an income and cost of living that affords no more than 60 percent of income is allotted to non-discretionary costs. Until this is accomplished, priority of effort must be focused on achieving it as the “price of admission” onto the roadmap. From there, employ the 60/20/20 budget management principle. Next, mitigate risk, pay down high-interest debt, and finally build a sufficient 3-to-12-month emergency fund. Phase two is focused on deploying one’s 20 percent of income allotted to savings in the most efficient and effective manner. Lastly, phase three is initiated in phase two by initiating an investment portfolio glide path, then preserving one’s wealth through more complex tax and investment withdrawal strategies in order to meet the enemy of taxes at the time and place of one’s choosing to keep non-discretionary costs low and avoid superannuation risk. As one progresses through these phases, complexity increases and often requires employing tax and financial planning experts. The roadmap is straightforward, but takes an educated, consistent, and disciplined approach. Though straightforward, it is not easy; if it were, nearly every American would achieve financial success. The good news is the whole process starts with education, which was my inspiration for writing this article and I do hope it convinces and empowers readers to begin the journey.

Did you know Sierra Hotel Financial offers to build complimentary financial plans for all active-duty military and military veterans? Contact us. https://sierrahotelfinancial.com/contact/

Pingback: When Is It Advantageous for Me to Do a Roth Conversion in My TSP? – Sierra Hotel Financial